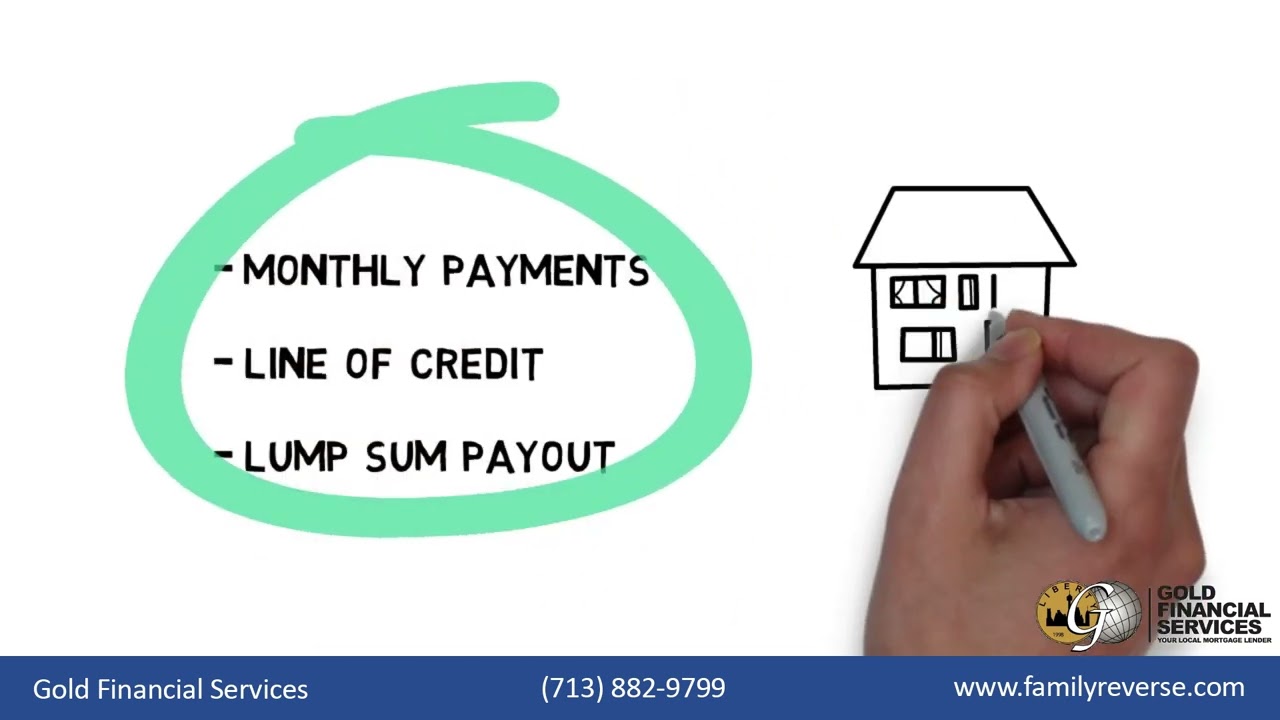

Eliminate required monthly mortgage payments and enjoy greater financial freedom in retirement. With a reverse mortgage, homeowners age 62 and older can remain in their home while easing cash flow and reducing monthly expenses. Free up income for everyday living, healthcare, travel, or long term planning, all while maintaining ownership of your home.